Annual rate of depreciation formula

A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. Finally the growth rate formula can be obtained by dividing the change in value step 3 by the initial value step 1 of the metric and then express the result in terms of percentage by multiplying by 100 as shown below.

Annual Depreciation Of A New Car Find The Future Value Youtube

1 asset useful life year depreciation amount cost of asset-residual value of asset annual depreciation rate Cost of asset.

. As a result the depreciation could reduce the investors taxable income and result in tax savings up front. Interest Rate Formula is helpful in knowing the Interest obligation of the borrower for the loan undertaken and it also helps the lender like financial institutions and banks to calculate the net interest income earned for the assistance given. Initial book value of the asset.

Read more on investment ROI then raising the result to the power of reciprocity of the tenure of investment. In our example the required investment is 8475 and the net annual cost saving is 1500. For tax purposes.

Explanation of Straight Line Depreciation Formula. For example if you are loaned 1000 and pay back 1100 over the course of a year your APR is 10. Such assets include mutual funds stocks and fixed deposits.

The company takes 50000 as the depreciation expense every year for the next 5 years. Annual depreciation expense 60000 - 10000 50000. First the actual decrease of fair value of an asset such as the decrease in value of factory equipment each year as it is used and wear and second the allocation in accounting statements of the original cost of the assets to periods in which the assets are used depreciation with the matching principle.

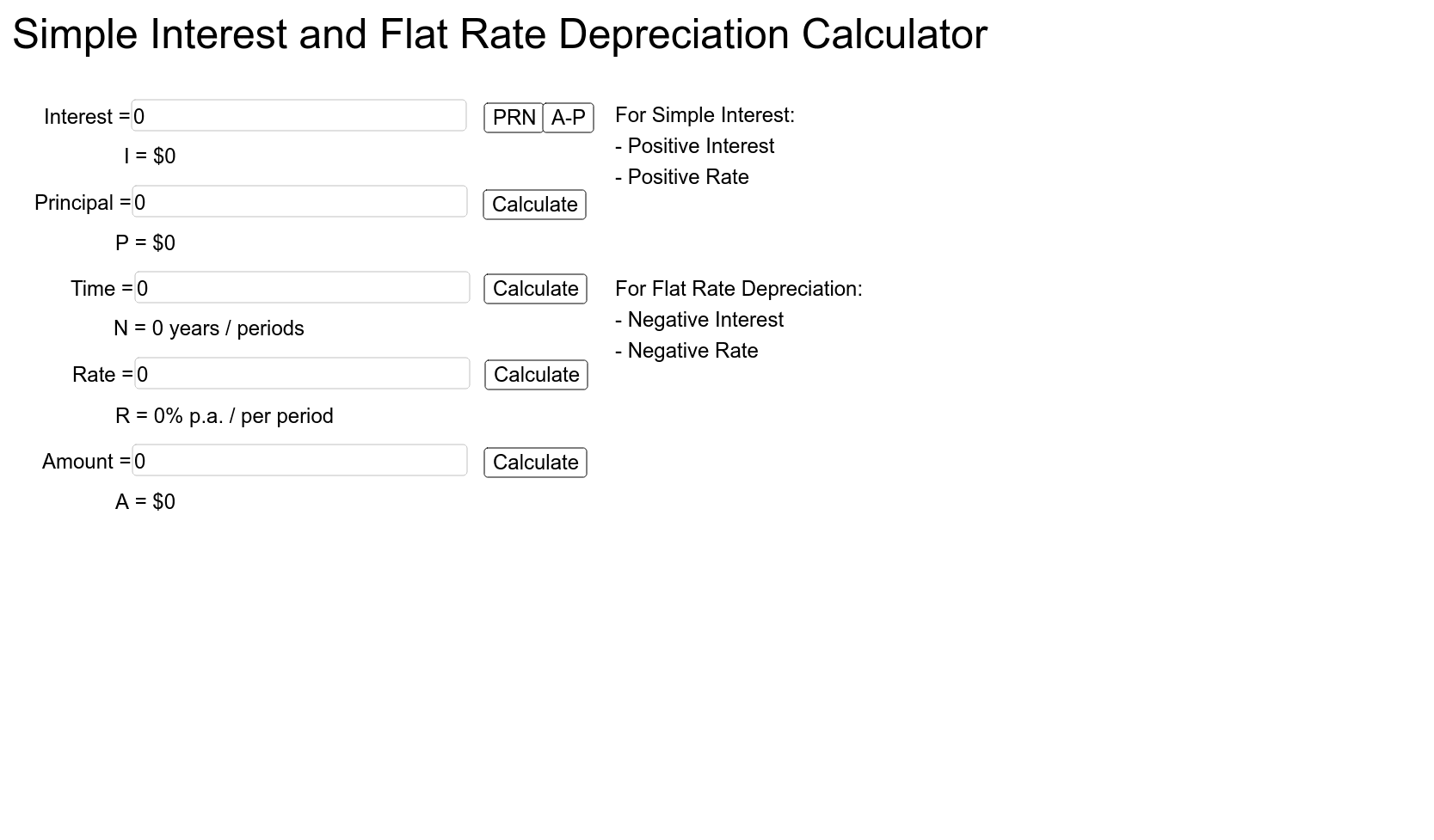

Finally divide the figure arrived in step 5 by the initial investment and resultant would be an annual accounting rate of return for that project. I Rs8750 So the interest earned by an investor on the redeemable bond is Rs8750. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100.

Example of straight-line depreciation without the salvage value. We will walk through an example of accelerated depreciation below. Growth Rate Final Value Initial Value Initial Value.

Straight Line Depreciation Formula allocates the Depreciable amount of an asset over its useful life in equal proportion. Depreciation 560000 Explanation. The formula is given below.

Annual amount of depreciation under Straight Line Method. What is the formula for calculating APR. It is not suitable for assets having long life and high value.

For example if a company has an annual depreciation of 2000 and the rate of tax is set at 10 the tax savings for the period is 200. Using the previous example if the computers lifespan is six years the straight-line depreciation rate would be 1 6 or 016. Using this information the internal rate of return factor can be computed as follows.

Find out more about FBT for employers in Chapter 74 Statutory formula method. Formula for Straight-line depreciation method Cost of an asset - Residual valueuseful life of an asset. Find the straight-line depreciation rate.

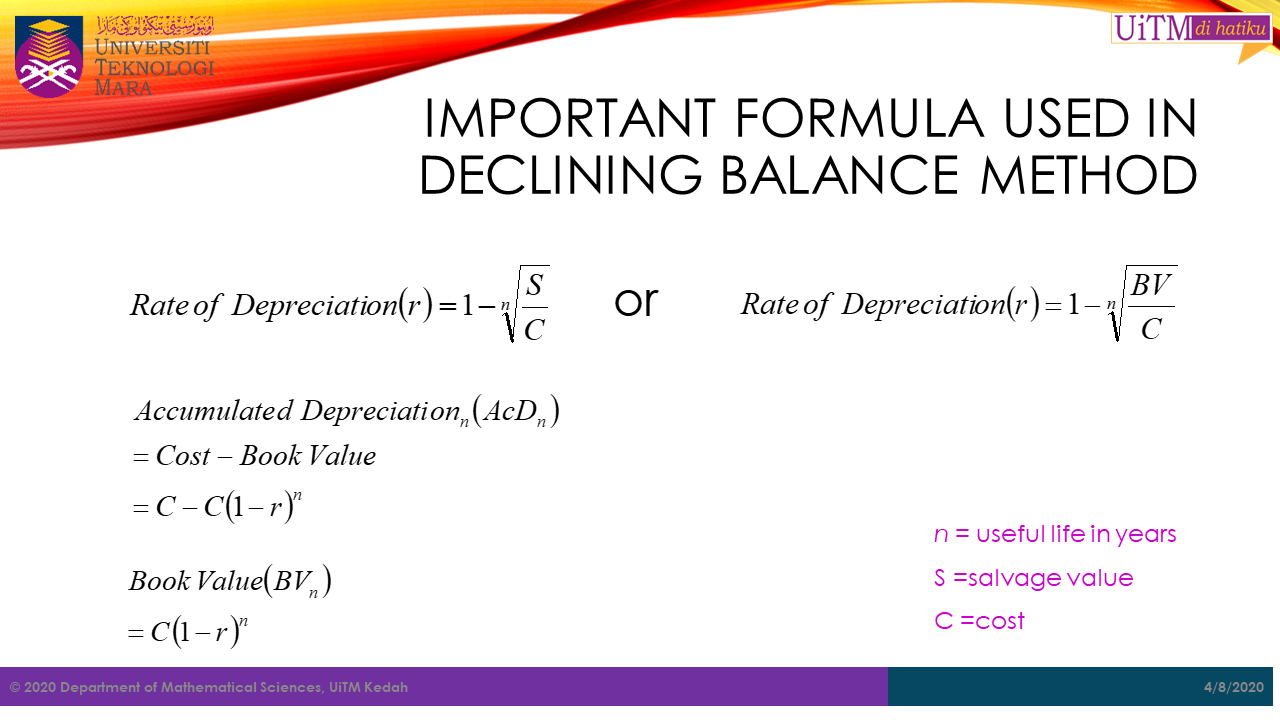

The straight Line Depreciation formula assumes that the benefit from the. Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset. Taking various expenses like insurance management fees inflation taxes legal fees staff salaries office rent and depreciation of plants and machinery the due consideration.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. Accelerated depreciation is the process of depreciating an asset in the first few years of ownership at a higher rate instead of doing so over time at a steady rate.

Cost of a Vehicle. Deemed depreciation rate cars. Percentage Change 274 Therefore the companys asset size has increased by 274 during the year.

Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life. In accountancy depreciation refers to two aspects of the same concept. Get 247 customer support help when you place a homework help service order with us.

500000-Scrap Value of Machine. APR refers to the inerest rate for a whole year of a loan. Depreciation Rate Formula straight-line method Formula.

I P R T. Annual Depreciation beginarraylfracOriginal Cost - Estimated Scrap ValueEstimated Useful Lifeendarray. Below are some of the examples to understand this concept better.

Average Rate of Return formula Average annual net earnings after taxes Average investment over the life of the project 100. For cars purchased on or after 10 May 2006 the depreciation rate is 25. The useful life of asset.

An annual percentage rate APR is the annual rate charged for borrowing or earned through an investment and is expressed as a percentage that represents the actual. Diminishing balance or Written down value or Reducing balance Method. For depreciation an accelerated depreciation method will also allocate more tax shield in earlier periods and less in later periods.

Businesses depreciate long-term assets for both tax and accounting purposes. Applying the formula So the manufacturing company will depreciate the machinery with the amount of 10000 annually for 5 years. After youve calculated the straight-line depreciation you can calculate its rate by dividing one by the assets lifespan years.

Percentage Change 375 million 365 million 365 million 100. The formula for calculating APR is A P1rt where A total accumulated amount P principal amount r interest rate and t time period. The formula for depreciation under the straight-line method can be derived by using the following steps.

Read more which can be calculated as per below. Depreciation Tax Shield Example. I 100000 7 125.

Relevance and Use of Growth Rate Formula. The diminishing value depreciation rates are used for car fringe benefits valued under the operating cost method. Annual Percentage Rate - APR.

It is difficult to ascertain a suitable rate of depreciation. Depreciation 2 35 million 070 million 10. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

The cost saving is equivalent to revenue and would therefore be treated as net cash inflow. Formula of internal rate of return factor. The formula can also be expressed by adding one to the absolute return Absolute Return Absolute return refers to the percentage of value appreciation or depreciation of an asset or fund over a certain period.

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Calculator Flash Sales 51 Off Www Ingeniovirtual Com

Depreciation Expense Calculator Online 55 Off Www Ingeniovirtual Com

Lesson 8 8 Appreciation And Depreciation Youtube

Depreciation Calculation

Math Sc Uitm Kedah Depreciation

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Formula And Calculation Excel Template

Gt10103 Business Mathematics Ppt Download

Depreciation Formula Examples With Excel Template

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Accumulated Depreciation Definition Formula Calculation

Depreciation Expense Double Entry Bookkeeping

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping